Paysage des fusions et réponses au Canada T1 2023 : Restez calme et continuezLe sentiment général à l’égard de la conclure des ententes prospectives au Canada à la fin du T1 de 2023 pourrait être mieux décrit comme un optimisme modéré, surtout par rapport à 2021 et au début de 2022. Malgré les vents contraires continus de divers facteurs macroéconomiques, le T1 a terminé sur une note encourageante avec une légère reprise de l’activité totale des transactions canadiennes (selon le nombre de transactions) par rapport au dernier trimestre. Cet examen trimestriel donne un aperçu du paysage des fusions et réponses au Canada pour le T1 de 2023. De plus, nous examinerons également certaines tendances récentes de l’activité de fusions et acquisitions au Canada avec une discussion sur l’élan accru pour les opérations de démarrage, les développements dans le financement de la dette dans les transactions de fusions et acquisitions et les transactions transfrontalières de SPAC qui s’avèrent résilientes. Un aperçu de l’activité des transactions de fusions et acquisitions au premier trimestre 2023Tous les chiffres sont selon les données de Bloomberg au 30 mars 2023, en dollars américains (transactions annoncées, conclues ou en attente, à l’exclusion de celles qui ont été résiliées ou retirées - lorsqu’une société canadienne est l’acquéreur, la cible ou le vendeur).

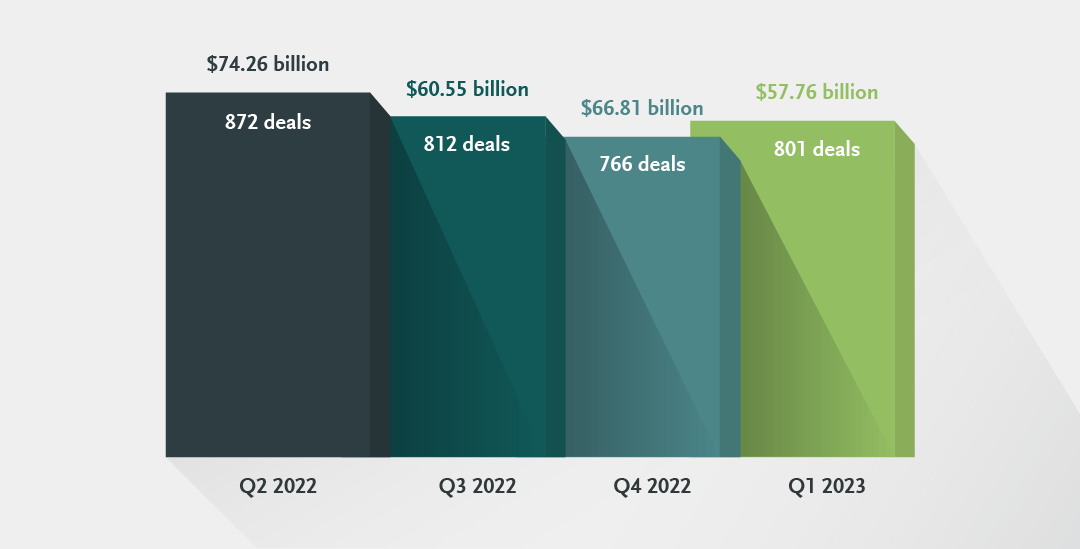

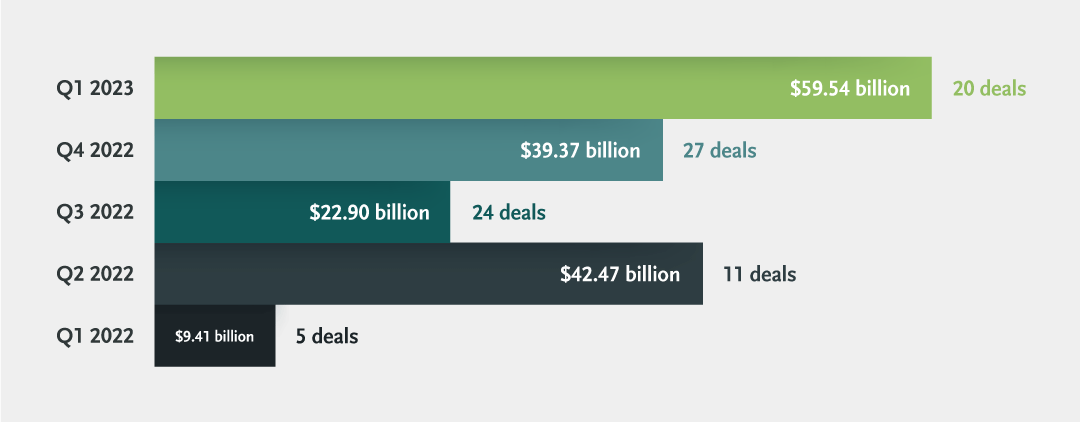

Au T1 de 2023, dans un contexte d’incertitude économique mondiale, l’activité de fusions et acquisitions aux États-Unis (un secteur traditionnellement solide pour les activités de fusions et acquisitions au Canada) a connu une baisse de la valeur et du nombre de transactions, une tendance conforme aux trois trimestres précédents. Bien que la valeur totale des fusions et réponses au Canada ait également diminué par rapport aux trois trimestres précédents, le nombre total d’opérations de fusions et services au Canada a augmenté, quoique modestement, passant de 766 transactions au T4 2022 à 801 transactions au T1 2023 (ce qui indique un mouvement vers des transactions plus petites) et est resté relativement cohérent avec le nombre de transactions au T3 et au T2 2022. Au cours du premier trimestre de 2023, trois secteurs ont mené l’activité totale de fusions et acquisitions au Canada (selon le nombre de transactions), à savoir l’exploitation minière, les logiciels et les FPI. L’exploitation minière est en tête des classements avec 1,94 milliard de dollars sur 229 transactions. Cependant, les logiciels étaient en avance massivement sur la valeur des transactions avec 11,6 milliards de dollars sur 68 transactions et suivis par les FPI avec 2,43 milliards de dollars sur 55 transactions. Tendances du T1 2023 en matière de fusions et réponses au CanadaTransactions de fermeture : Le nombre de transactions privées aux États-Unis et au Canada (en baisse par rapport au T4 et au T3 de 2022) a fortement augmenté au T1 de 2023 par rapport à la même période l’an dernier. De manière générale, il y a eu une hausse globale de l’activité de placement privé et la valeur totale des affaires a plus que sexué depuis le début de 2022. De plus, selon PitchBook, les entreprises privées de logiciels ont pris un « bon départ » en 2023, avec trois transactions représentant, au total, 5,6 milliards de dollars et représentant plus du tiers des entreprises privées à ce jour , une tendance prometteuse pour les secteurs hautement novateurs de la technologie et des logiciels du Canada.

Le tableau ci-dessus comprend toutes les opérations privées au Canada et aux États-Unis, y compris toutes les opérations qui impliquent des partenaires non canadiens/américains. Financement : Malgré l’incertitude du marché à partir de 2022 qui se poursuit en 2023, le rythme de l’inflation au Canada a continué de décélérer et s’est refroidi à 5,2 % en février, soit la plus forte décélération depuis avril 2020, selon Statistique Canada. De plus, les hausses des taux d’intérêt ont fait une pause au Canada et ont ralenti au sud de la frontière. La Banque du Canada n’a pas augmenté les taux d’intérêt le 12 avril, ce qui marque la deuxième fois en une année que les taux n’ont pas augmenté. Aux États-Unis, la Réserve fédérale américaine n’a relevé ses taux que de 25 points de base le 22 mars. Ces données économiques positives, qui pourraient normalement être une aubaine pour le financement de la dette, ont été tempérées par les effets des récentes turbulences dans les systèmes bancaires américains et internationaux. Transactions de dé-SAVS : La forte baisse de l’activité d’introduction en bourse de la SAVS se poursuivra probablement en 2023, mais les fusions entre les États-Unis.et les cibles cotées en bourse (une transaction « de-SPAC ») se sont avérées plus résilientes. À la fin de mars 2023, il y avait environ Plus de détails sont disponibles dans l’examen détaillé de Bennett Jones sur Canada Cross-Border De-SPAC Transactions: What US-Listed SPACs and Canadian Companies Need to Know. Regard vers l’avenirAlors que la tourmente dans le secteur des services financiers s’est produite dans la dernière partie du T1, son impact total sur l’activité de fusions et acquisitions pour le reste de l’année reste à voir. Il semble clair que les vents contraires de l’économie mondiale continueront de créer un environnement difficile à court terme. D’une manière générale, cependant, rien n’indique une baisse abrupte de la transaction à partir de 2023. Les acheteurs stratégiques et financiers continuent de faire des affaires et de nombreuses industries, en particulier l’exploitation minière et les logiciels, vont de l’avant malgré la volatilité des marchés. Nous nous attendons à ce que ces tendances se poursuivent. La pratique Mergers & Acquisitions de Bennett Jones couvre toutes les industries, en particulier celles qui stimulent l’économie canadienne. Pour discuter des développements et des opportunités qui façonnent le paysage canadien des fusions et réponses, veuillez contacter les auteurs. Auteur(e)s

Traduction alimentée par l’IA. Veuillez noter que cette publication présente un aperçu des tendances juridiques notables et des mises à jour connexes. Elle est fournie à titre informatif seulement et ne saurait remplacer un conseil juridique personnalisé. Si vous avez besoin de conseils adaptés à votre propre situation, veuillez communiquer avec l’un des auteurs pour savoir comment nous pouvons vous aider à gérer vos besoins juridiques. Pour obtenir l’autorisation de republier la présente publication ou toute autre publication, veuillez communiquer avec Amrita Kochhar à kochhara@bennettjones.com. |

S’abonner

Restez au fait des dernières nouvelles et de nos événements dans le domaine des affaires et du droit.

Blogue