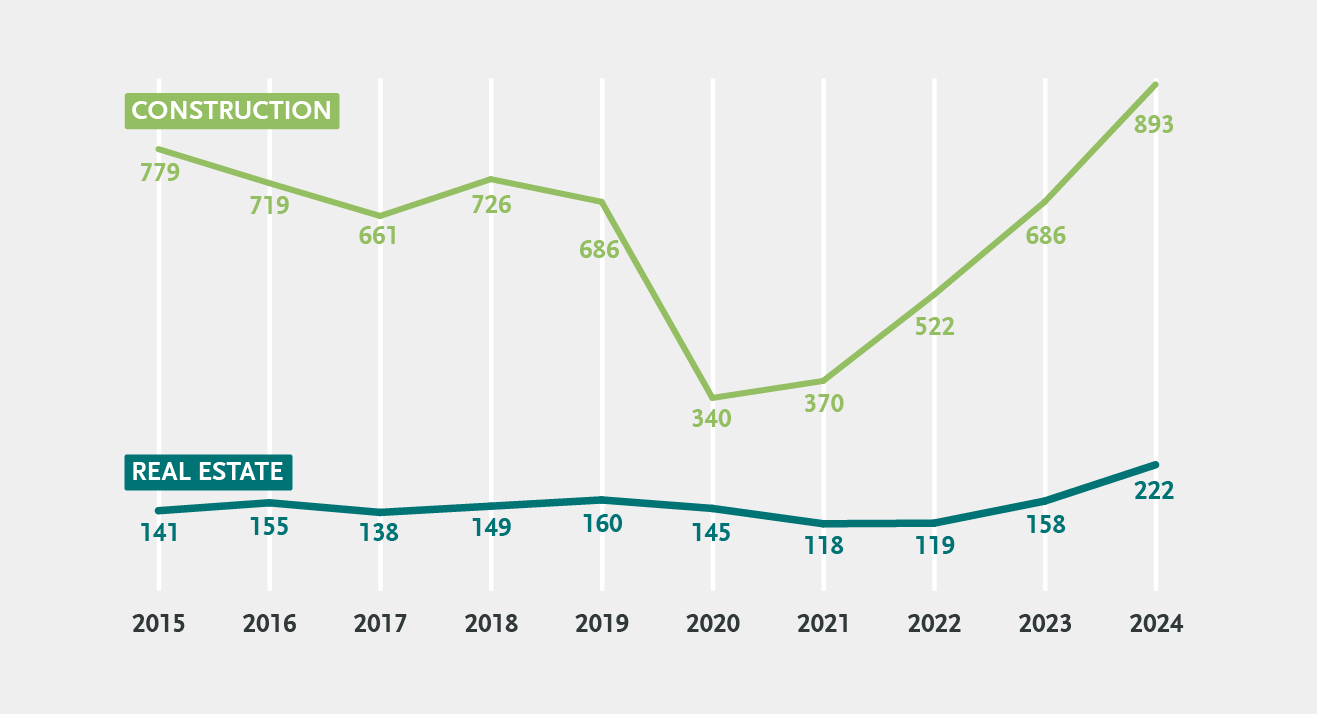

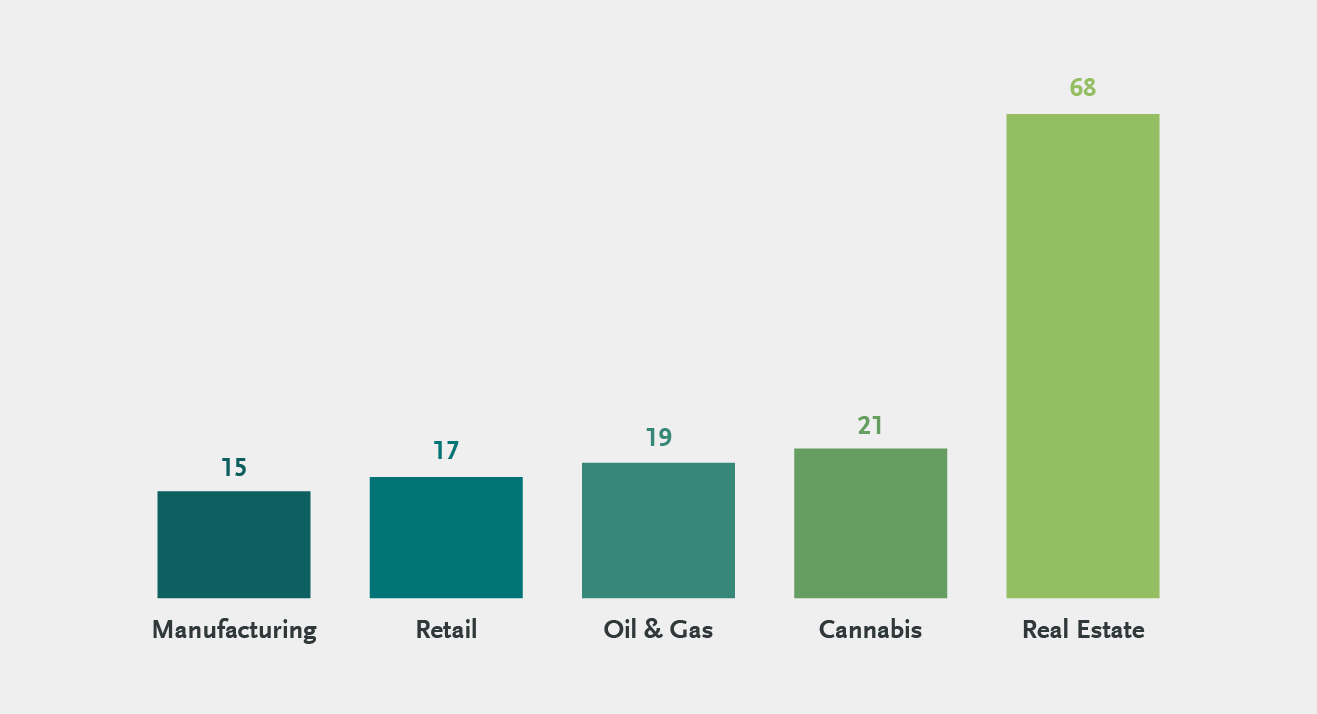

The Year Ahead: Five Trends in Distressed Real Estate in 2025The Canadian residential development industry is facing an unprecedented wave of financial distress. Debtor-initiated real property (including rental and leasing) insolvencies spiked in 2024, rising by 42.5 percent year-over-year, while receivership appointments in the real estate sector reached their highest level in roughly a decade. Following this trend, insolvencies also jumped in the construction industry in 2024, increasing by 30 percent from 2023, and representing more insolvency activity than in any other economic sector, according to the Office of the Superintendent of Bankruptcy Canada. These events were driven by several underlying factors that are expected to continue into 2025, and this sector may be met with additional headwind. Here is a look at five key trends emerging from 2024 and what they mean for real estate market stakeholders. Real Estate and Construction Insolvencies in Canada 2015-2024Source: Office of the Superintendent of Bankruptcy Canada Ever Changing Interest RatesUntil early June 2024, interest rates stood at five percent—the highest they had been since 2001. The Bank of Canada’s policy interest rate has recently been trending downward and now sits at three percent, with interest rates offered by Canadian lenders following a similar trend. However, these rate fluctuations have impacted both developers and home buyers alike and introduced uncertainty at all phases of the development cycle. Development CostsThe rising cost of construction has affected the entire real estate industry. Since 2020, it has become exponentially more expensive to build real estate due to supply chain disruptions, labour shortages, material costs and the increase in price of municipal development permits. Delays in the municipal development permitting process also impact developments by extending the duration of project financing during the pre-construction period, while construction costs continue to increase during any period of delay. Although construction starts have tapered and labour and material costs remain elevated from pre-pandemic levels, trade availability has increased, providing some relief from the record-high pricing experienced in 2022-2023. Similarly, public policy has yet to relieve pressure on the significant soft costs borne by the developer through development cost charges and municipal fees. In Multifamily, Fewer Starts, Fewer BuyersIn the multifamily sector, these pressures on developers and homebuyers create a negative feedback loop: facing higher costs, developers are breaking ground on fewer projects; while at the same time, consumer habits are shifting as investor-buyers are increasingly reluctant to purchase pre-construction condominiums. In many submarkets, the secondary condominium markets have slowed significantly, if not stalled altogether. Ironically—and unfortunately—the slowdown in construction starts and loss of consumer confidence comes at a time when there is a well-established housing shortage across Canada. Decrease in Investment and Increase in EnforcementBanks and private credit lenders are less likely to lend money in the current real estate and financial climate. While experienced developers with larger balance sheets may be relatively insulated from this trend, smaller and less experienced developers are facing an increasingly constrained fundraising environment. The lack of pre-sales compounds this problem. Enforcement is on the rise as well. 2024 saw lenders becoming increasingly emboldened in enforcing real estate-backed loans in distress. This is a shift from the pandemic years, when lenders were hesitant to take enforcement steps. We expect this trend to continue in 2025. Trouble in Residential and Uncertainty in Office Real EstateTwenty-five percent of the insolvent properties in 2024 from the Insolvency Insider Canada’s database were residential development projects. There were reported sixty-eight insolvency filings in real estate last year (including debtor-initiated proceedings and creditor-initiated receiverships)—more than three times the next most active industry. Insolvency Filings in Canada in 2024Source: Insolvency Insider Canada Political UncertaintyAdding to these existing challenges is the current political climate. Political turmoil roared into 2025 with Canada’s (so far) near-miss on massive across-the-board US tariffs and potential retaliatory measures. More recently, 25 percent steel and aluminum tariffs have been announced by the US President. This tumult creates significant uncertainty with respect to housing policy, and potential material exposure to project balance sheets as the spectre of a potential trade war looms. What Role Can Bennett Jones Play?Bennett Jones works with clients in distressed real estate to navigate the complexity and achieve results in this area:

To discuss how Bennett Jones can help in any aspect of distressed real estate in Canada, please contact any of the authors. Authors

Please note that this publication presents an overview of notable legal trends and related updates. It is intended for informational purposes and not as a replacement for detailed legal advice. If you need guidance tailored to your specific circumstances, please contact one of the authors to explore how we can help you navigate your legal needs. For permission to republish this or any other publication, contact Amrita Kochhar at kochhara@bennettjones.com. |

Blog