A variety of factors are expected to significantly increase Canadian M&A activity in 2025. These include the likelihood of a more merger friendly regulatory environment in the United States for cross-border transactions, lower inflation, stabilized interest rates, a continued surplus of institutional capital and the necessity of private equity groups to effect exits. We expect to enter 2025 with some positive momentum in Canadian dealmaking.

Dealmaking trends in Canada that we are tracking as we head into the new year include an expected increase in mid-market transactions and private equity exits, continued traction in infrastructure M&A and investment activity, Canadian technology companies continuing to engage in going private transactions and AI’s increasing impact on M&A deals.

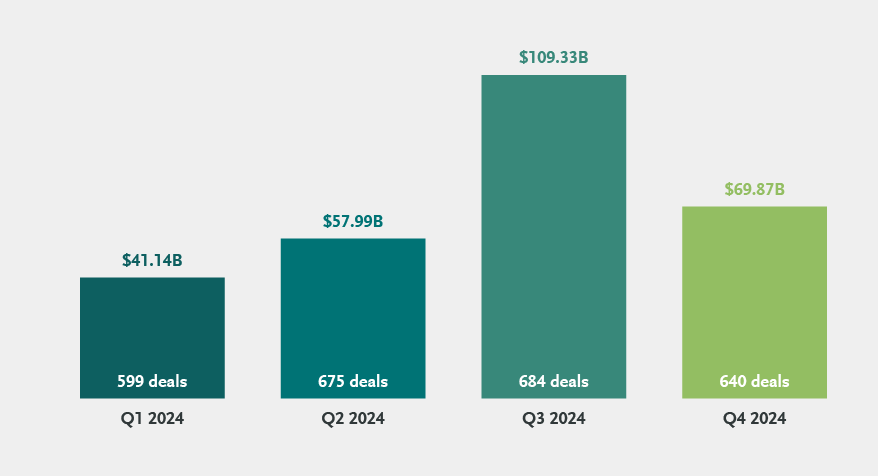

2024 Canadian M&A Deal Activity

The total value of deals in 2024 rose by $51.4 billion, or 23 percent, from the previous year, although the numbers of transactions decreased. While the number of private equity sponsored M&A transactions also increased in 2024, the overall value of private equity transactions rose sharply.

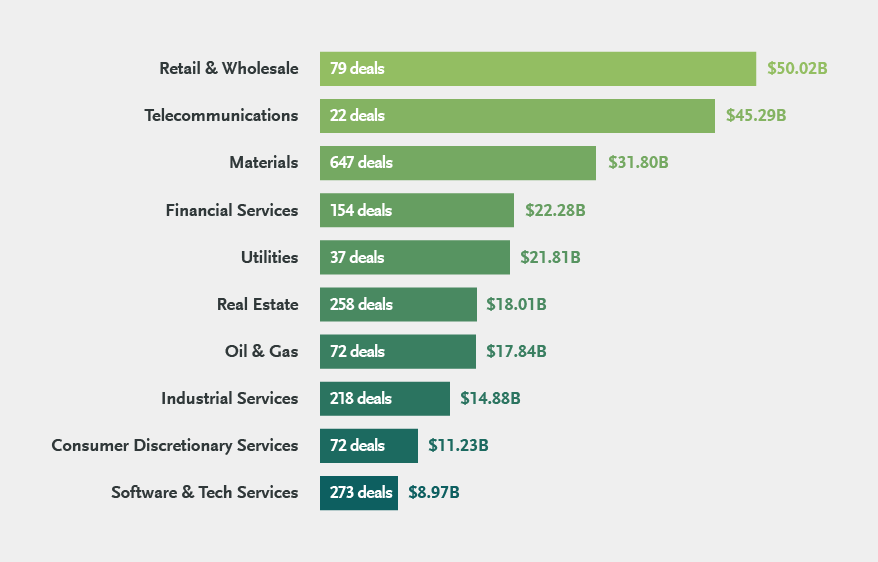

Canadian M&A by Industry 2024: Bloomberg Industry Group

Couche Tard's $47 billion proposed acquisition of Japan's Seven & i Holdings accounted for almost all the announced value in retail and wholesale. There were also five multi-billion dollar deals in the telecommunications sector.

Mining and metals led the way in the materials industry with $20.51 billion on 582 deals—including Gold Fields’ acquisition of Osisko Mining for $1.39 billion, First Majestic’s acquisition of Gatos Silver for $970 million and Westgold and Karora’s $800-million merger.

Canadian Natural Resources Limited’s announced acquisition of Chevron's Alberta assets for $6.5 billion was the largest oil and gas deal in 2024. WSP’s acquisition of Power Engineers for $1.78 billion was the third biggest deal in industrial services, and Park Lawn’s $885 million going private transaction was a top five deal in consumer discretionary services.

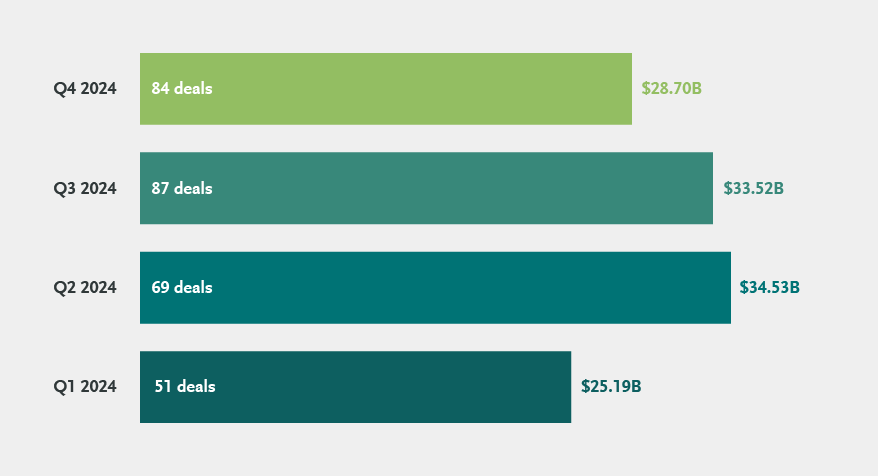

Canadian Private Equity Dealmaking and Mid-Market Deals

Canadian private equity M&A transactions climbed in both deal value and volume in 2024. There has been $121.93 billion in private equity deal activity this year, up 44 percent from $84.76 billion in 2023.

Over the last two years, private equity firms in Canada have held assets much longer than usual and many investments are now ripe for exits. A high number of private equity exits were delayed in 2024, and we expect more to occur in 2025 as transaction certainty, including stabilized and improving rates on M&A financings, has returned to the marketplace. This should result in more potential targets. We also expect to see continued consolidation and an increase in mid-market deals in 2025—largely the result of a shortage of high-quality targets in 2024, a better financing environment and large accumulated cash surpluses for private equity firms and companies.

These expected activities, together with the increased pressures for greater distributions to limited partners, bodes well for dealmaking in 2025. Many private equity firms softly tested the Canadian market in 2024 to see if there was any appetite for their portfolio assets, but several sale processes were not properly launched.

Financing costs and related uncertainty are not likely to act as an impediment to deal activity in Canada in 2025. There even could be a return of a more traditional Canadian IPO market with many portfolio companies becoming more mature during this period and open to considering an IPO exit strategy. The improving rate environment, when coupled with the continuing growth of private credit as a M&A financing source, should ensure the receptive and deal-friendly credit markets needed to complete larger transactions in Canada and increase M&A activity in 2025.

Infrastructure M&A and Investments

It was a busy 2024 for infrastructure transactions and the range of investments in the sector continues to expand. Telecommunications had a standout year with $45.29 billion in total announced value on 22 deals. Three of the top ten Canadian M&A transactions in 2024 were in the telecommunications industry. Utilities was the fifth busiest area this year with $21.81 billion on 37 deals. $13.67 billion worth of utilities deals were in renewable energy. There was an additional $6.31 billion in non-utilities renewable energy transactions in 2024. Infrastructure investment has been one of the more notable recent growth stories of any asset class in Canada.

In 2025, we expect to see a continued increased presence for Canadian, U.S. and global institutional infrastructure players investing in traditional Canadian infrastructure and near-infrastructure assets. Energy transition and critical minerals focused transactions will continue to be a key driver of infrastructure investment activity in Canada. This includes renewables and energy efficient focused projects, together with investments in digital transformation and infrastructure, including data centres, telecom towers, cloud capacity and AI.

Technology Companies Going Private

There were 273 software and technology services deals in 2024—the second highest total by sector. 219 of the 273 are in software and 54 are in IT services. While private equity players were still deploying capital, public shareholders were more willing sellers than private equity participants in Canada in 2024.

Over the past three years, Canada's public technology sector has witnessed a notable surge in M&A activity with respect to going private transactions, sales processes and shareholder activism. The Globe and Mail recently highlighted that 71 private Canadian technology and technology-enabled companies have surpassed US$100 million in annual revenue—and the number is probably more than that. Several more companies are almost there and 19 have hit the US$300-million mark.

This uptick reflects broader global trends and market conditions that have shaped the sector, including a heightened focus on strategic private equity acquisitions and investments in the technology space.

This past year has been no different. We have seen several prominent examples of Canadian public technology companies going private in 2024 such as Nuvei Corporation, mdf commerce, Copperleaf Technologies, TrueContext Corporation, Q4, Givex Corporation and others.

This trend can be largely attributed to a combination of depressed stock prices, difficulty in accessing capital and disconnects in intrinsic value, changing market conditions and growing interest from well-capitalized U.S. private equity firms. For many Canadian public technology companies in 2024, market performance no longer reflected their underlying growth potential.

The momentum behind going private transactions in Canada's technology sector will continue in 2025, as several strategic review and sales processes were announced by large players in the industry such as Kinaxis, Lightspeed Commerce, Dye & Durham and others.

Fueled by a combination of market dynamics and broader economic conditions, we expect that the less-than-robust Canadian capital markets activity in 2024 will continue to act as a catalyst for more going private deals and strategic reviews in the technology sector in the months ahead.

AI in Canadian Dealmaking

As new AI innovations and technologies are introduced to the Canadian marketplace, we expect that AI will continue to become a more integral part of the transaction process in 2025. AI capabilities will continue to be adopted by market participants, from deal sourcing and target identification, to streamlining the due diligence and M&A process to post-closing integration. More market participants will adopt and integrate AI tools as these technologies increasingly impact every transaction.

Looking Ahead

2025 is looking to be a year where momentum meets opportunity in Canadian dealmaking. There is more certainty as market conditions have improved. M&A financing is available on much better terms. Deal activity has been moving in the right direction in several key areas. Challenges will remain and new ones may arise as geopolitical risks persist on a global scale and closer to home. But overall, the obstacles are fewer, and increased opportunities should be more available. Dealmakers are on increasingly solid ground in Canada’s M&A landscape as we enter 2025.

Bennett Jones M&A Practice

Bennett Jones' Mergers & Acquisitions practice spans all industries—particularly those that drive the Canadian economy. To discuss the developments and opportunities shaping the M&A landscape, please contact the authors.

All numbers are according to Bloomberg data in U.S. dollars unless otherwise stated (announced, completed or pending deals—excluding those that have been terminated or withdrawn—where a Canadian company is the acquirer, target or seller) as of December 24, 2024.