Changes to Canada's Iran Sanctions - Your Questions Answered (and a Flowchart)On February 5, 2016, the Government of Canada amended its economic sanctions on Iran to significantly ease restrictions on doing business. The changes were in response to Iran's compliance with its the commitments to restrict its nuclear proliferation activities under the Joint Comprehensive Plan of Action with the P5+1 countries and the consequential easing of UN Security Council sanctions and economic sanctions imposed by the EU, the United States and other countries. The changes to Canada's sanctions are designed to allow for what the government called a "controlled economic re-engagement" with Iran. The changes significantly ease the legal constraints on doing business with Iran. However, certain important restrictions remain that can serve as traps for the unwary. With that in mind, here are answers to some of your most frequently asked questions about these changes. What exactly are Canada's economic sanctions?Economic sanctions (sometimes called trade embargoes) are a means for the international community and/or the Government of Canada to put political pressure on a foreign government by restricting economic opportunities for that country. Canada currently has two sets of economic sanctions in force against Iran. The first are those mandated by the United Nations (UN) Security Council, which are implemented in Canada through the Regulations Implementing the United Nations Resolution on Iran (SOR/2007-44) under the United Nations Act (R.S.C., 1985, c. U-2) (the UN Regulations). The UN sanctions, which are consistent across UN member states, focus on Iran's military and nuclear proliferation activities and include a list of restricted individuals and entities with whom doing business is prohibited and a list of arms, ballistic missile technology and nuclear-related goods that cannot be supplied to Iran. In addition to the UN sanctions, Canada maintains unilateral economic sanctions against Iran that are set out in the Special Economic Measures (Iran) Regulations (SOR/2010-165) under the Special Economic Measures Act (S.C. 1992, c. 17) (the SEMA Regulations). It is these SEMA Regulations that have most significantly restricted business dealings between Canada and Iran in recent years. What changed on February 5 about Canada's sanctions on Iran?Canada lifted the broad restriction on trade, investment and financial transactions with Iran previously contained in the SEMA Regulations and has switched to a list-based model under which business with Iran is generally permitted unless:

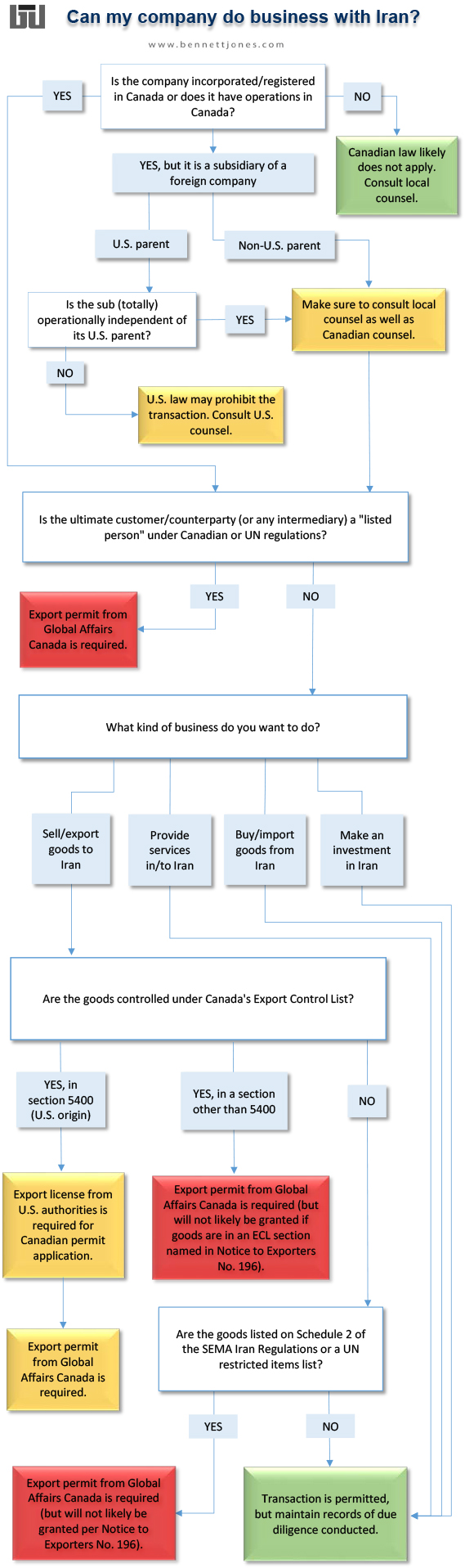

These amendments follow the issuance of General License H by the U.S. Office of Foreign Assets Control on January 16, 2016, which effectively removed the application of U.S. sanctions on Iran to independently operated foreign subsidiaries of U.S. companies. (See more details about the U.S. amendments in this blog post.) These two developments mean that Canadian businesses now have significantly more leeway than previously to trade in goods and services with Iran and invest in Iran. For a more detailed summary of the changes to the Canadian sanctions, see Bennett Jones blog post, Canada Eases Iran Sanctions and Opens Trade for Key Industrial Sectors. So, what does this mean for my business?It may be possible to do business with Iran, provided that you have engaged in sufficient due diligence and received legal advice to confirm that none of your company's proposed activities falls within any remaining restrictions either in Canada or abroad. Because the ownership of Iranian assets by state-linked entities is pervasive and those ownership interests can often be murky, due diligence will be remain critical in order to, among other things, ensure that you are not doing business with listed entities, such as, for example, the Iranian Revolutionary Guard Corps. The Criminal Code also lists certain terrorist entities and prohibits most dealings with them. The entities listed there include one branch of the Iranian Revolutionary Guard Corps. Ok, I have confirmed that my goods are not listed on Schedule 2 or under the UN Regulations and my customer is not listed on Schedule 1, under the UN Regulations, or as a terrorist entity, and that my company is not subject to foreign sanctions restrictions. Does this mean I can ship my goods freely to Iran?Not yet. You also need to consider whether the goods are subject to general export controls. By a separate regulatory regime distinct from its economic sanctions, Canada, under the Export and Import Permits Act (R.S.C., 1985, c. E-19) maintains a list of strategic goods that cannot be exported from Canada to any destination without a permit. This Export Control List (SOR/89-202) (ECL) includes a wide range of goods with potential nuclear, military, or intelligence applications as well as certain miscellaneous categories of products. Details about the products contained in the list are set out in Global Affairs Canada's Guide to Canada's Export Controls. On the same day that the Government of Canada announced the amendments to the Iran sanctions regulations, it also issued Notice to Exporters No. 196, which emphasizes that irrespective of the easing of the Iran sanctions, Global Affairs Canada will generally deny permits to export many of the goods on the ECL to Iran, namely those with military, nuclear or dual-use applications. Notably, one of the miscellaneous categories in the ECL, section 5400, covers all U.S.-origin goods and technology not otherwise listed in the ECL which have not been substantially transformed in Canada into another good. Section 5400 means that all goods of U.S. origin require an export permit to be re-exported from Canada. Most exporters of U.S. origin goods do not need to apply for transaction-specific export permits because they can rely on General Export Permit No. 12 (GEP-12) when preparing their export documentation. However, GEP-12 is not applicable in respect of exports to four specific countries: Cuba, North Korea, Syria, and Iran. This means that notwithstanding the substantial lifting of Canadian economic sanctions, any company that re-exports controlled goods or any goods of U.S. origin even if those goods are not otherwise controlled, cannot export those goods to Iran without having first obtained a transaction-specific export permit. Until February 5, the SEMA Regulations prohibited most financial transactions involving Iran. Now that this prohibition has been lifted, will it be easier for my company to get paid for goods or services it sells to Iran?Yes, but be careful. A number of major Iranian financial institutions are still listed under Schedule 1 to the SEMA Regulations. Most financial transactions involving those institutions remain prohibited. In addition, you can expect that many international banks will be very cautious in processing financial transactions involving Iran until they get a better sense of the administrative and enforcement regime that accompanies the amended sanctions in Canada and abroad, particularly in the United States. This is all very confusing. Can you break down for me visually whether I can do business with Iran?Below is a chart that illustrates the types of questions that will need to be asked and answered when engaging in sanctions and export controls-related due diligence. It is not a substitute for legal advice. Legal counsel should be involved in the conversation to help determine the answers to the questions below and to identify any other potential legal or regulatory issues that could arise in relation to your transaction.

Authors

Please note that this publication presents an overview of notable legal trends and related updates. It is intended for informational purposes and not as a replacement for detailed legal advice. If you need guidance tailored to your specific circumstances, please contact one of the authors to explore how we can help you navigate your legal needs. For permission to republish this or any other publication, contact Amrita Kochhar at kochhara@bennettjones.com. |

Blog