Written By Linda Misetich Dann, Christian Gauthier and Harinder Basra

While Canadian M&A activity slowed in Q3, many companies and investors continue to have the appetite and capital to do M&A transactions, including private equity funds who continue to seek accretive opportunities to deploy capital in a number of sectors in the Canadian economy. As was the case throughout the first half of 2022, deals are being done and opportunities are there, but investors are showing restraint and gone are the days of doing a deal at any cost.

Significant challenges remain as we move into the final three months of 2022. Central banks around the world continue to increase interest rates in their fight against inflation and have signaled that rates will continue to rise in the near term. Concerns of a recession persist and so do geopolitical uncertainties.

What's needed is stability, so that buyers and sellers can have a better sense of pricing, execution and risk. Stability (or some sense of it) will allow new baselines to be set for post-pandemic performance for companies and their industries. When this happens, deal activity can be expected to pick up, and perhaps quickly.

It's not if, it's just when.

Q3 2022 M&A Deal Activity

All numbers in this section are according to Bloomberg data (announced, completed or pending deals, excluding those that have been terminated or withdrawn) as of September 30, 2022, in US dollars.

If we review M&A volume and deal count for the first three quarters in each of the past five years, helpful trends emerge that are applicable to 2022. Q1-Q3 totals are lower than a record-breaking 2021 and higher than 2019, the last full year not affected by the pandemic.

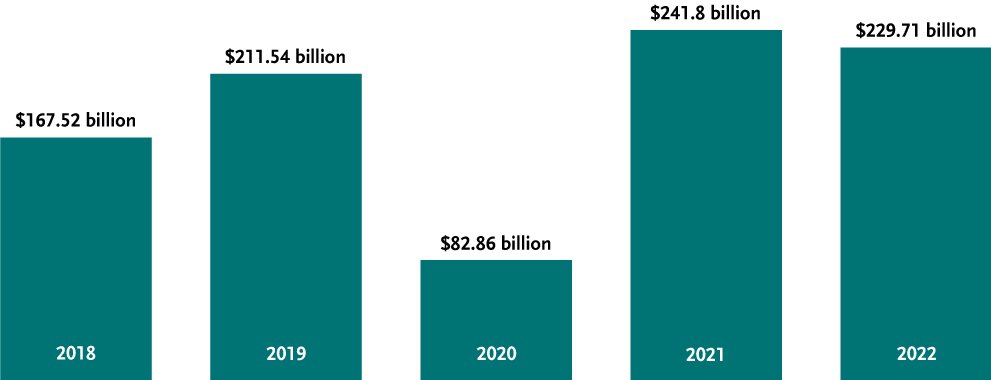

Q1-Q3 Canadian M&A Deal Volume: 2018-2022

M&A volume in the first nine months of 2022 was $229.7 billion and has already surpassed the full year M&A volume of 2018 ($225.7 billion). FY for 2019 was $279 billion.

It must be noted that deal volume in Q4 2021 was a historic $115.4 billion, a feat that may not be repeated for some time.

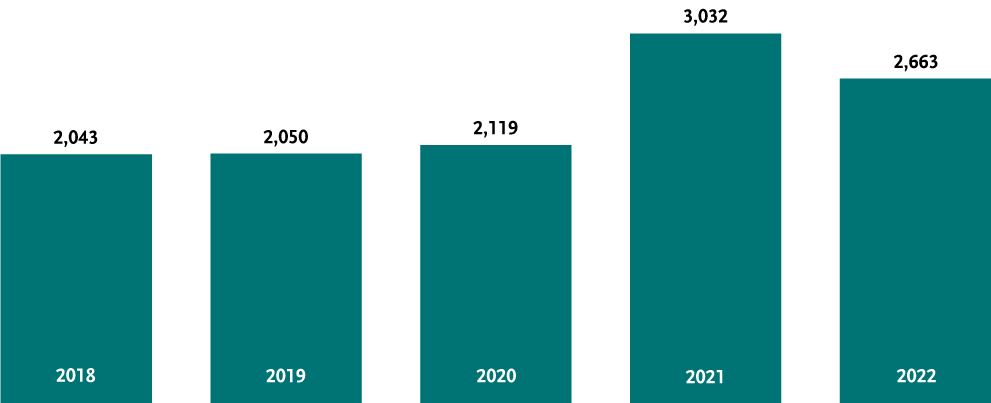

Q1-Q3 Canadian M&A Deal Count: 2018-2022

The number of deals so far in 2022 is 30 percent higher than the first three quarters in each of 2019 and 2018. There were a total of 2,753 deals in 2019 and 2,804 deals in 2018.

Quarterly and Monthly Volume

M&A deal volume in Canada was down in the third quarter of 2022 to $63.9 billion, from $78.9 billion in Q2. Volume was $86.9 billion in Q1.

July 2022 was a busy month with $33.4 billion in activity, August declined to $17.8 billion. September fell further to $12.8 billion, the second lowest monthly total of the year. The decline in Q3 deal activity should not be seen as a surprise, though. It is consistent with what the markets have been seeing in the past quarter.

As well, another common theme in the deal making world in the past three months was people taking some well-deserved time off over the summer. This was the first time that many had a vacation in over two years and it was a hard-earned break. Many organizations told their people to make the most of the opportunity to recharge, so the slower M&A deal activity during the summer months may be partly a reflection of this.

Canadian M&A 2022: Monthly Volume

Natural Resources

From a mining perspective, there continues to be a desire to get deals done. And the demand continues for base metals, precious metals and battery metals.

A July 2022 report by the International Energy Agency said the world needs up to 50 more lithium mines, 60 more nickel mines and 17 more cobalt mines by 2030 to meet the projected demand in electric vehicle battery supply chains. Lithium has the largest projected demand-supply gap and nickel is facing the largest demand increase by 2030. Timing is a serious factor—it takes a minimum of 10 years to bring a mine into production (if everything goes right).

The oil and gas sector continues to feel the pull of opposing forces—of potentially tight supply on one hand and fears of a global recession on the other—all with the backdrop of the geopolitical uncertainty caused by Russia's invasion of Ukraine. M&A activity in the sector was muted in Q3 and uncertainty was the driving factor. For example, WTI was US$108.43 at the beginning of Q3 2022 and US$79.49 at the end of the quarter, a decline of over 25 percent.

What's Next in 2022

In Bennett Jones' Q2 2022 look at Canadian M&A, we described how companies and investors were "forging ahead through choppy seas." This continues to be the case at the end of Q3. Deals are being done and companies continue to look at potential transactions—as market fluctuations affect decisions on whether or not to proceed at this time.

Through all of this, confidence and optimism remain among companies, investors and dealmakers. And when stability returns, so will a steady level of deal activity.

It's not if, it's just when.

Bennett Jones' Mergers & Acquisitions practice spans all industries, and particularly those that drive the Canadian economy. To discuss the developments and opportunities shaping the Canadian M&A landscape, please contact the authors.

Please note that this publication presents an overview of notable legal trends and related updates. It is intended for informational purposes and not as a replacement for detailed legal advice. If you need guidance tailored to your specific circumstances, please contact one of the authors to explore how we can help you navigate your legal needs.

For permission to republish this or any other publication, contact Amrita Kochhar at kochhara@bennettjones.com.